8 Things to Look Out for When Selecting a Forex Broker

Forex market refers to the foreign exchange market which is one of the largest financial markets and has a daily trading volume of approximately 6 trillion USD. The forex market cannot be accessed directly for trading, traders need an intermediary to trade it, which is where forex brokers come into the picture. Forex brokers offer traders trading platforms where they can buy and sell currency pairs to make profits from the fluctuations in their prices.

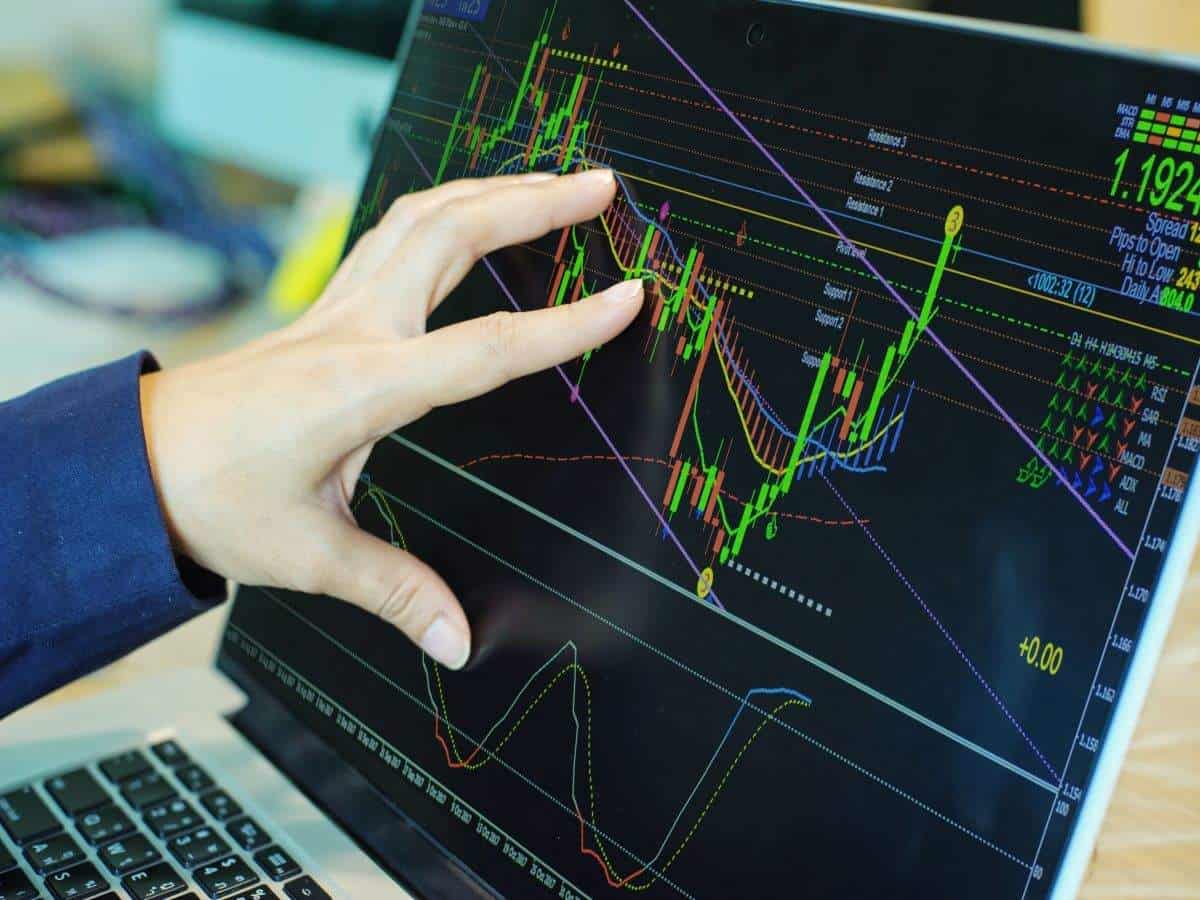

Forex Trading

Forex trading is the speculation of currency prices to make profits. Traders study the market and anticipate the possible future market movements to make trades. The currencies in forex are traded in pairs that are pre-determined and whose sequence cannot be changed. The first written currency is known as the base currency and the second written currency is the quoted currency. For e.g., EUR/USD, here EUR (Euro) is the base currency and USD (US dollar) is the quoted currency pair.

A trader buys a currency pair when he anticipates the price of the base currency to increase and the price of the quoted currency to fall. On the contrary, the trader sells a currency pair when he anticipates that the price of the base currency might fall and the price of quoted currency might increase.

What is a Forex Broker?

As mentioned above, the forex market cannot be accessed directly and a medium is required. The forex broker acts as this medium that allows traders to access the forex market to make trades. They allow traders to open, hold and close a trading position on the trading platform they provide. In other words, a forex broker and Forex Signals is a financial service firm that allows traders access to the trading platform where they can trade global currencies.

Types of Forex Brokers

-

Dealing Desk Brokers

Dealing desk forex brokers are those brokers where the trade is executed and traded by the market maker. In other words, the dealer facilitates the trades for their clients.

-

No-dealing Desk Brokers

No-dealing desk forex brokers allow traders to access the market directly without any involvement of a third party. No-dealing desk forex brokers are of two types – STP (Straight Through Processing) forex brokers and ECN (Electronic Communication Network) forex brokers.

8 Things to Consider When Selecting a Forex Broker

-

Regulations

To ensure the reliability and trustworthiness of the forex broker, regulations are the first things to look out for. There are many regulatory authorities around the world. For eg. brokers in the US are regulated by National Futures Association (NFA) and Commodity Future Trading Commission (CFTC), in the UK the brokers are regulated by FCA and by CySEC in Cyprus. The brokers comply with the rules and regulations of these authorities.

-

Commissions and Spreads

Commissions are the charges charged by the forex broker for each trade done. Whereas the spread is the difference between the ask and bid price that depends on the liquidity of the currency pairs. Forex brokers offer two types of spreads – floating and fixed spreads. It is important to look for a forex broker with tight spreads and fairly low commissions.

-

Initial Minimum Deposit

Initial minimum deposit is the minimum amount required to open a trading account with a particular forex broker. Many brokers offer initial deposits to be as low as $10 and as high as $200. It depends on the traders to which amount they can be comfortable with. Beginners are suggested to start with a low amount.

-

Leverage and Margin

Leverage allows traders to open a larger trading position with a relatively small amount of money. The margin on the other hand is the minimum amount required to open and hold a trading position. The leverage is represented in ratios such as 1:30. However, leverage is a double-edged sword and traders must be very careful while trading leverage.

-

Hassle-free Deposit and Withdrawals

Forex brokers have various transaction options for depositing and withdrawing funds. Traders should always check the transaction processing fees. There are many brokers that do not charge any processing fees.

-

Trading Platforms Offered

Forex brokers offer forex demo account and different trading platforms like MT4, MT5, cTrader and traders can choose any one of them to make their trades. Traders choose a trading platform based on their trading strategies. These trading platforms are useful in conducting fundamental and technical analyses for making trading decisions. Traders should study the trading platform, features, and trading tools offered before trading live. Traders can also practice on the demo account using the preferred trading platform to get familiar with the platform.

-

Currency Pairs Offered

Forex brokers offer a wide array of currency pairs for traders to trade with. However, it is not mandatory that the currency pair a trader wishes to trade is always available with the broker. Therefore it is better to check the currency pairs offered by the broker.

-

Customer Service

As forex trading is conducted 24 hours a day and 5 days a week, responsive and well-disposed customer service support is very important. Timing in forex is very crucial and a trader does not want to lose because of a delay in resolving a technical issue.

There are a number of forex brokers, brokers review sites and Forex Books in the market and choosing one can be a tedious job. Traders should do their own research before committing to any broker. The above-mentioned points can be used as a reference while choosing a forex broker.