Overview

FOREX.com Review

Introduction

FOREX.com is a global market leader that provides a variety of trading services. It was founded in 2001 as a division of GAIN Capital Holdings. In February 2020, StoneX Group Inc. purchased GAIN Capital Holdings. Through institutional-grade platforms, end-to-end clearing and execution, and high-touch expertise, StoneX Group Inc., a publicly traded company, claims to connect clients to global markets across asset classes.

FOREX.com offers a wide range of asset classes across the globe namely forex, stocks, CFDs, spread betting, and futures. FOREX.com also offers trading commodities as commodities, indices, bonds, ETFs, gold & silver, cryptocurrencies, and futures. Furthermore, the broker provides client account protection options like ESMA-mandated negative balance protection and stop-loss orders with guarantees which makes it a safe broker.

Is FOREX.com Safe?

FOREX.com is a registered Futures Commission Merchant (FCM) and Retail Foreign Exchange Dealer (RFED) with the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association. Also, StoneX Group, the parent company, is held to the highest standards of corporate governance, financial reporting, and disclosure and is listed on the NASDAQ.

Features Offered by FOREX.com

Trading Assets:

FOREX.com provides global access to a broad range of financial instruments from numerous asset classes. You can trade assets such as forex, metals, indices, bonds, forex, commodities, and more. Additionally, FOREX.com offers access to stocks from more than 4500 companies and 80+ currency pairs. Additionally, CFDs are the only way to trade cryptocurrencies; trading the underlying asset is not an option. Notably, trading cryptocurrency CFDs is not permitted for U.K. citizens or retail traders from any broker’s U.K. entity.

Educational Materials:

FOREX.com offers a variety of high-quality educational resources that simplifies learning. Both beginning traders and seasoned investors can benefit significantly from the educational resources provided by the broker. Basic trading knowledge, fundamental & technical knowledge, risk management, trading tactics, etc can be learned by watching the videos and reading articles. Also, FOREX.com provides videos on operating the platform and webinars to hone your trading and investing skills.

Trading Tools:

FOREX.com provides various tools to improve your trading such as charts, economic calendars, news, order histories, signals, research reports, etc. The advanced trading platform offers sophisticated trading features and analytical tools for both seasoned and newbies.

Trading Accounts:

FOREX.com offers MetaTrader accounts, commission accounts, direct market access accounts, and standard trading accounts. For traders looking for regular spread pricing, the standard account is perfect. For traders seeking ultra-tight spreads with fixed commissions, commission accounts are ideal. DMA accounts are also appropriate for forex traders seeking the most control.

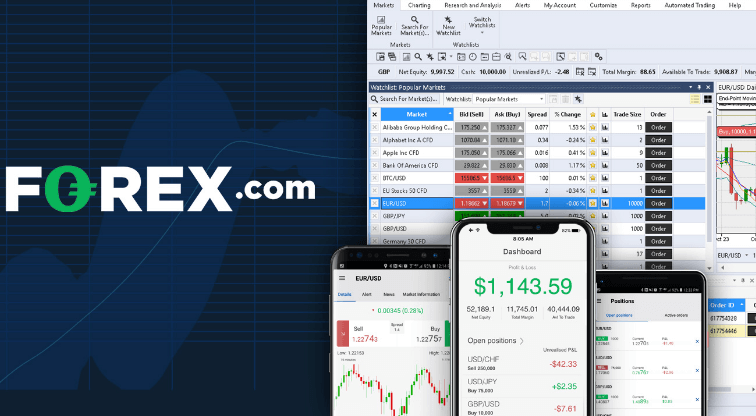

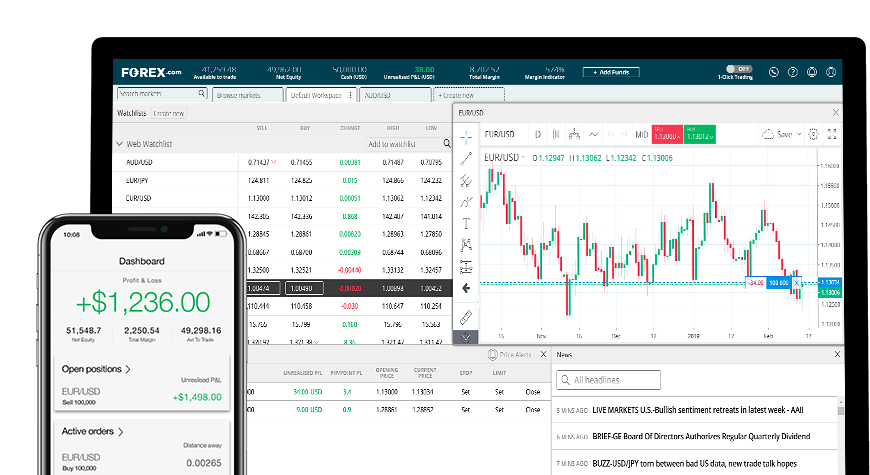

Trading Platforms:

FOREX.com provides three types of trading platforms: mobile trading, web trading, and advanced trading platforms. With top-notch responsiveness, speed, and performance across all browsers, the Web trading platform has been optimised according to the needs of the traders. Also, the mobile trading platform is compatible with both Android and iOS, giving you access to a complete trading environment.

Swap-free Islamic Accounts:

Muslims who strictly adhere to the laws of Shariah, cannot pay or accept any kind of interest. As swaps are a form of interest, they are considered prohibited. By offering Islamic accounts to Muslim traders, FOREX.com can help them engage in the financial markets without hurting their religious sentiments.

Customer Service:

Customers can get in touch with FOREX.com in a number of ways, including online chat and live phone support, from 10 a.m. ET on Sunday to 5 p.m. ET on Friday. The quickest way to get answers from the broker is through phone support.

Trading Conditions:

- Inactivity Fee: After 12 months of no trading activity, FOREX.com charges an inactivity fee.

- Minimum Deposit: When funding with Neteller, Skrill, or a credit or debit card, the minimum deposit at FOREX.com for the Standard and Commission accounts is typically $100. Whereas, the DMA account requires $25,000 in deposits. When funding by wire, there is no minimum per transaction.

- Leverage: FOREX.com provides a default leverage setting of 50:1 which cannot be changed. However, accounts for MetaTrader 4 can be scaled back to 10:1 and 20:1.

- Commission: For Forex trading, FOREX.com charges some amount known as commissions. $5 commission per standard lot (100K) is added to the low variable spreads used for trading in commission accounts. Whereas, variable commissions based on traded volume apply to STP Pro Accounts.

- Spreads: Spreads vary depending on the account chosen by the trader. Average spreads are high at 1.1 pips (1.3 in the U.S.) on the EUR/USD pair in a standard account. In a DMA account, spreads for the EUR/USD pair are 0.03 pips. For U.S. clients, the minimum EUR/USD spread on a standard account is 1 pip, while spreads on commission and STP Pro accounts are 0.2 and 0.1 pips.

Pros of Trading with FOREX.com

- FOREX.com offers a variety of resources

- Both Android and iOS have mobile trading options.

- Fast trade execution

- Trading expenses are low

- Low minimum deposits

- Spreads and commissions are competitive

- The platform is simple to use and navigate.

- Wide range of resources and tools are available

- More than 80+ forex currency pairs are available for trading.

- High leverage

- Offers numerous indicators

- Excellent customer support.

- For its UK/EU clients, the broker offers negative balance protection.

CONS of Trading with FOREX.com

- Cannot trade other securities like bonds

- No guaranteed stop losses for U.S. clients

- Inadequate website maintenance

Conclusion

Overall, due to its huge selection of tradable assets, low account minimums, and outstanding trading platform, FOREX.com is a great broker. Its ability to provide a variety of account types, multiple user interfaces, access to a wide range of financial instruments, competitive spread and commission costs, and excellent research resources is by far this broker’s strongest suit. Additionally, FOREX.com’s extensive educational resources provide traders of all experience levels with free, in-depth knowledge of forex trading.